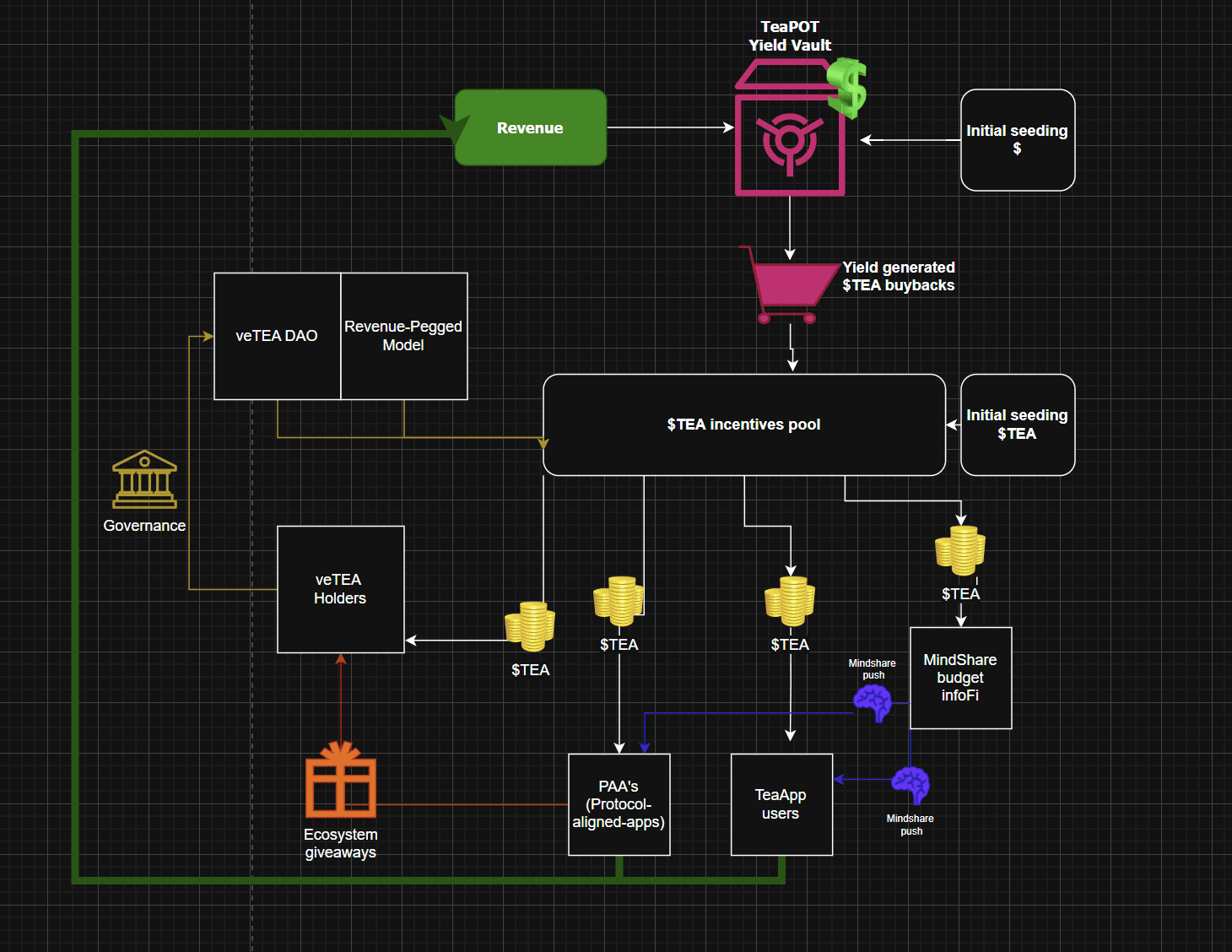

DeFi promised freedom, but too often it delivers fragility. Protocols lure users with flashy incentives, only to watch liquidity vanish when the rewards dry up. At Tea-Fi, we believe sustainability is the real innovation. That’s why we built the TeaPOT — an ever-growing, protocol-owned vault that transforms every action, from a simple swap to a partner integration, into lasting rewards and long-term growth. The TeaPot isn’t just a treasury, it’s the economic heartbeat of TEA-Fi, designed to compound value forever.

By aligning incentives with actual engagement, the TeaPOT ensures that value flows to those who actively contribute, fostering a robust and sustainable decentralized finance (DeFi) ecosystem.

The TeaPOT: A Compounding Economic Engine

The TeaPOT serves as the protocol’s liquidity hub, capturing revenue from all corners of the TEA-Fi ecosystem and reinvesting it to drive growth. Unlike traditional models that rely on passive emissions or extractive stakeholders, the TeaPOT is built for long-term sustainability. Its principal—revenue from user activity and partner integrations remains untouched, compounding over time, while only the generated yield is used for buybacks and rewards.

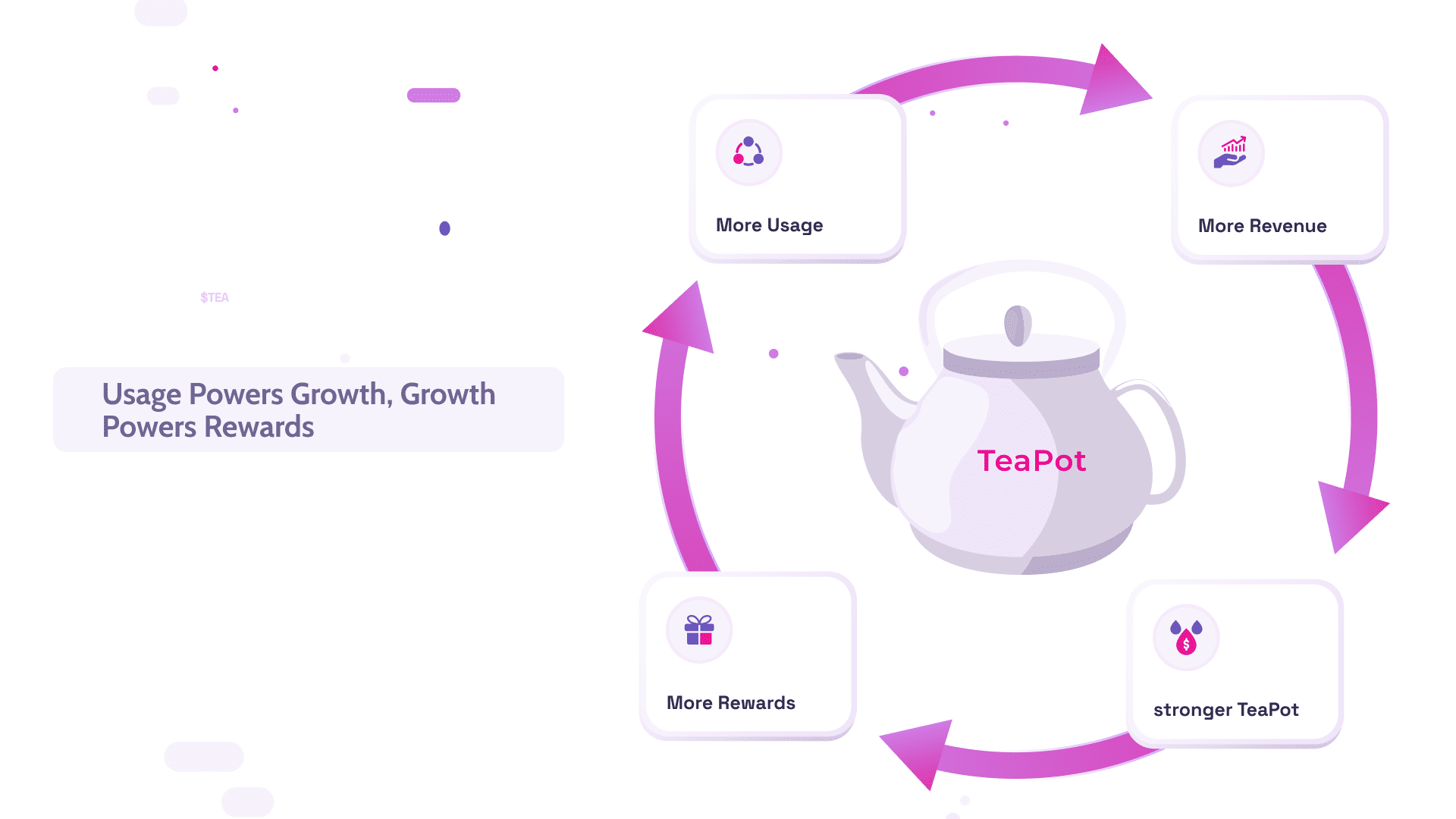

This creates a virtuous cycle: more usage generates more revenue, which strengthens the TeaPOT, leading to greater rewards and, in turn, even more usage.

The TeaPOT’s vision is to convert every interaction, whether through vault deposits, swaps, card usage, or partner integrations into a resource for ecosystem growth. By reinvesting revenue into $TEA buybacks, the Incentive Pool (via TEA-DROPS), and future utilities, the TeaPOT ensures that value remains within the ecosystem, benefiting active participants and reinforcing trust through sustainable, yield-based operations.

Revenue Streams Fuelling the TeaPOT

The TeaPOT draws revenue from multiple layers of the TEA-Fi ecosystem, creating a diversified and resilient income stream:

- TEA-Fi Core Products: Revenue is generated from user interactions with TEA-Fi’s foundational offerings, including wallet activity, swap fees, on/off-ramp fees, card usage, and auto-earn features. These core products form the backbone of the TeaPOT’s revenue model.

- Protocol-Aligned Apps (PAAs): External decentralized applications (dApps) that integrate with TEA-Fi’s infrastructure such as gas abstraction through No Gas (NOGA), lending platforms, or vault layers, contribute a share of their revenue to the TeaPOT. This alignment ensures that partner success directly strengthens the TEA-Fi ecosystem.

- Premium Services (Future): As TEA-Fi evolves, premium services like advanced analytics, professional tools, and additional layers will generate further protocol-level income, expanding the TeaPOT’s capacity to fund rewards and innovation.

Yield Allocation: Balancing Growth and Rewards

The TeaPOT splits its captured value equally to balance operational needs with user incentives:

- Protocol Operations: This portion funds infrastructure, development, and support, ensuring the TEA-Fi ecosystem remains robust and scalable.

- $TEA Buybacks: The remaining yield is used to buy back $TEA tokens from the open market, which are then redirected into the Incentive Pool and distributed through the TEA-DROPS system.

These buybacks are governed by vTEA holders, who vote to allocate rewards based on strategic alignment and platform engagement. This governance model ensures that rewards are tied to meaningful contributions, not speculative or passive capital.

Activity-Based Rewards: The TEA-DROPS System

Unlike traditional DeFi protocols that reward liquidity providers regardless of engagement, TEA-Fi’s TEA democratic redistribution on PAAs and services (TEA-DROPS) system distributes $TEA incentives based on real activity. The TeaPOT does not emit tokens directly; instead, it powers a dynamic reward layer that evaluates contributions across several dimensions:

- Product-Level Interactions: Rewards are tied to activities like wallet holdings, card usage, etc.

- Partner Integrations: PAAs that generate value for the ecosystem contribute to and benefit from TEA-DROPS.

- Wallet Holdings: Only vTEA-weighted holdings qualify for rewards, ensuring alignment with long-term stakeholders.

- Governance Participation: Votes on TEA-DROPS distribution by vTEA holders further tie rewards to active involvement.

This activity-based model ensures that rewards are earned with purpose, incentivizing meaningful engagement over passive speculation.

The PAA Model: A Network of Shared Growth

One of the TeaPOT’s strength lies in its ability to foster collaboration with Protocol-Aligned Apps (PAAs), external dApps that integrate with TEA-Fi’s infrastructure, such as EasyGas (NOGA). These apps contribute a share of their revenue to the TeaPOT, creating a mutually beneficial relationship. In return, vTEA holders vote to determine which PAAs receive TEA-DROPS, rewarding those that drive the most value to the ecosystem.

This structure incentivizes PAAs to:

- Drive high-quality user activity.

- Increase total value locked (TVL) or transaction volume through TEA-Fi’s infrastructure.

- Optimize their operations to align with the utiliTEA economy.

In some cases, PAAs may offer additional benefits to vTEA holders, such as a share of their native token emissions, protocol fees, or dedicated utility rights. These benefits can be distributed proportionally to vTEA holdings, based on activity within the PAA, or through future integrations with the TeaPOT. This creates a multidirectional value loop where vTEA holders power the ecosystem, and PAAs return value to those who support it most.

The TeaPOT thus acts as a distribution router, channeling value to aligned partners and users. As the ecosystem grows, the TeaPOT becomes the economic heart of a modular network of native and external apps, all reinforcing one another through a shared, vTEA-governed reward layer.

Initial Distribution Plan: Bootstrapping the UtiliTEA Economy

To kickstart the TEA-Fi ecosystem and ensure immediate incentives, TEA-Fi employs a strategic token distribution model:

- A fixed base pool of $TEA tokens to seed early activity.

- An ongoing stream of buybacks powered by the TEAPot’s yield, ensuring long-term sustainability.

Emission Timeline (Base Pool $TEA)

The $TEA base pool is released gradually over multiple years to balance early momentum with controlled supply pressure:

The TeaPOT as a Growing Vault

The TeaPOT operates as an ever-increasing yield vault, with its principal (bonds and revenue deposits) locked indefinitely to compound over time. Only the yield is used for buybacks, ensuring perpetual growth and reinforcing future rewards. This structure transforms the TeaPOT into a permanent economic flywheel, fostering trust and sustainability as the ecosystem scales.

Governance: vTEA Holders Shape the Future

vTEA holders play a pivotal role in the TEA-Fi ecosystem, guiding the distribution of TEA-DROPS and shaping ecosystem priorities. Through monthly governance votes, they determine how rewards are allocated to users and PAAs, ensuring that incentives align with actual engagement and strategic goals. This governance model empowers long-term stakeholders to drive the protocol’s growth while maintaining a fair and transparent reward system.

Conclusion: A Self-Sustaining Ecosystem

The TeaPOT transforms user and partner activities into a self-reinforcing cycle of growth, rewards, and sustainability. By capturing revenue from core products, Protocol-Aligned Apps, and future premium services, the TeaPOT ensures that value remains within the ecosystem. Its activity-based TEA-DROPS system, governed by vTEA holders, rewards meaningful contributions while fostering collaboration with external partners. Furthermore, with a carefully designed initial distribution plan and ongoing yield-based buybacks, the TeaPOT bridges early adoption with long-term scalability, creating a DeFi ecosystem where every interaction fuels shared prosperity.

As TEA-Fi grows, the TeaPOT will continue to evolve as a modular, ever-expanding hub, uniting native and external apps in a shared mission to deliver value to users, partners, and vTEA holders alike.