In decentralized finance, value is often scattered across chains, protocols, and liquidity pools. Tea-Fi brings order to this chaos through the $TEA token, the value layer that connects every product, service, and partner across its ecosystem.

More than a token, $TEA is the foundation of a self-sustaining economy that grows stronger with every user interaction. Every swap, vault deposit, and partner integration flows into the TeaPOT, a protocol-owned liquidity engine that recycles real yield back into the system. This process turns platform activity into perpetual growth, ensuring that every transaction strengthens both the network and the token itself.

Utility That Reflects Real Value

$TEA is not a speculative token. It is designed around real utility and measurable outcomes. All revenues from the Tea-Fi ecosystem eventually cycle through the TeaPOT, where they are used for buybacks, reinvestment, and ecosystem rewards. This creates a model where growth is backed by genuine yield rather than unchecked inflation.

Holding $TEA also unlocks deeper participation within the Tea-Fi network. It serves as the gateway to vTEA, a system that provides access to governance, boosted APYs, premium utilities, and community campaigns. In Tea-Fi’s world, token ownership translates directly into empowerment and influence

vTEA: Turning Commitment into Utility

Tea-Fi introduces vTEA, a non-transferable governance and utility token created by locking $TEA. It represents both capital and time commitment, rewarding users who choose to stay aligned with the ecosystem for the long term.

The longer users lock, the more they gain in influence, rewards, and loyalty bonuses. This system transforms passive holding into active participation, measured through Tea-Fi’s guiding equation:

Capital × Trust = utiliTEA

Through veTEA, Tea-Fi converts commitment into measurable impact, ensuring that those who believe in the mission of taking the hassle out of crypto are recognized and rewarded accordingly.

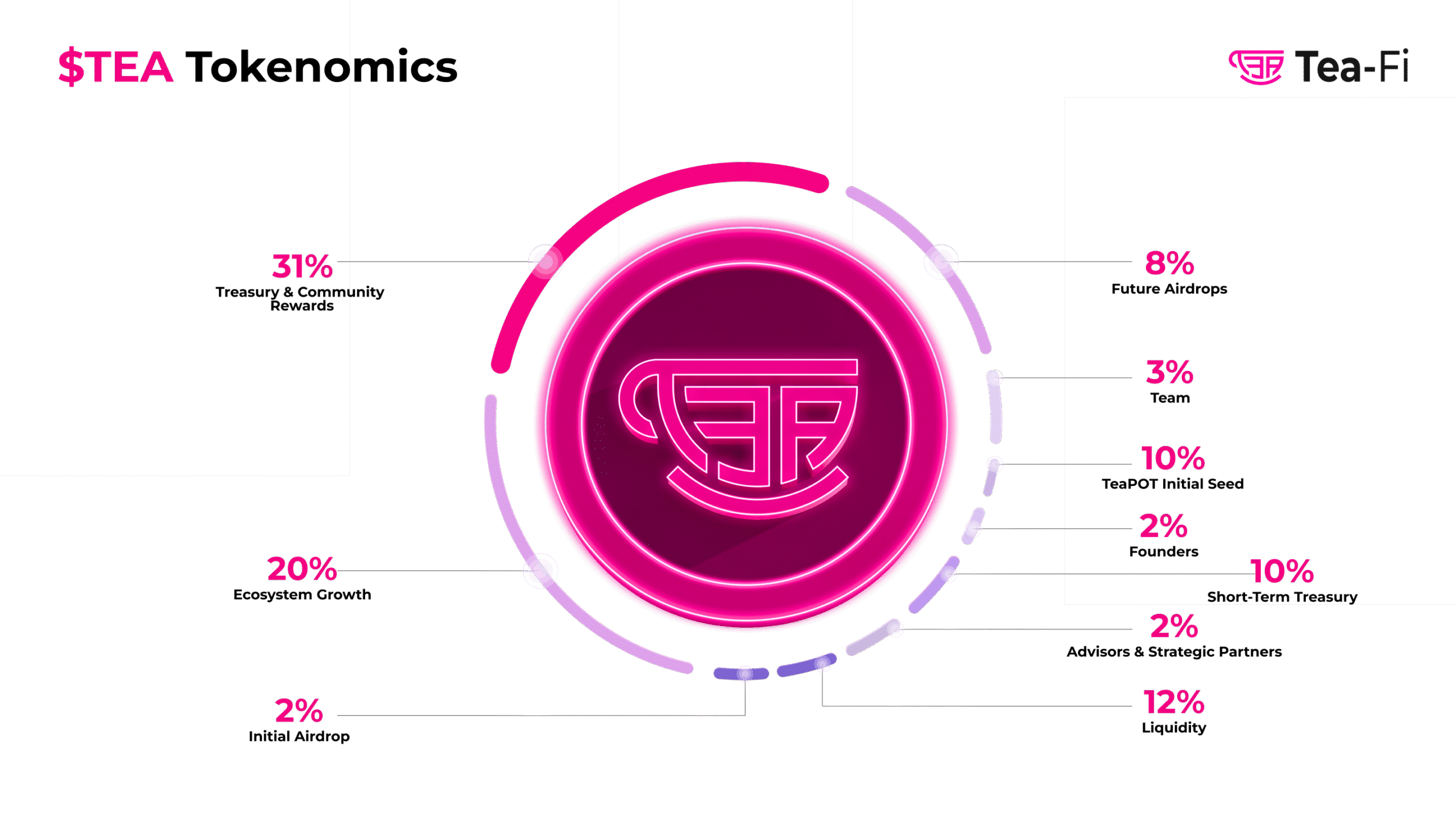

Token Supply and Distribution

The total supply of $TEA is capped at 300 million tokens, distributed across strategic allocations that balance ecosystem stability, community ownership, and future expansion.

Token Distribution Overview:

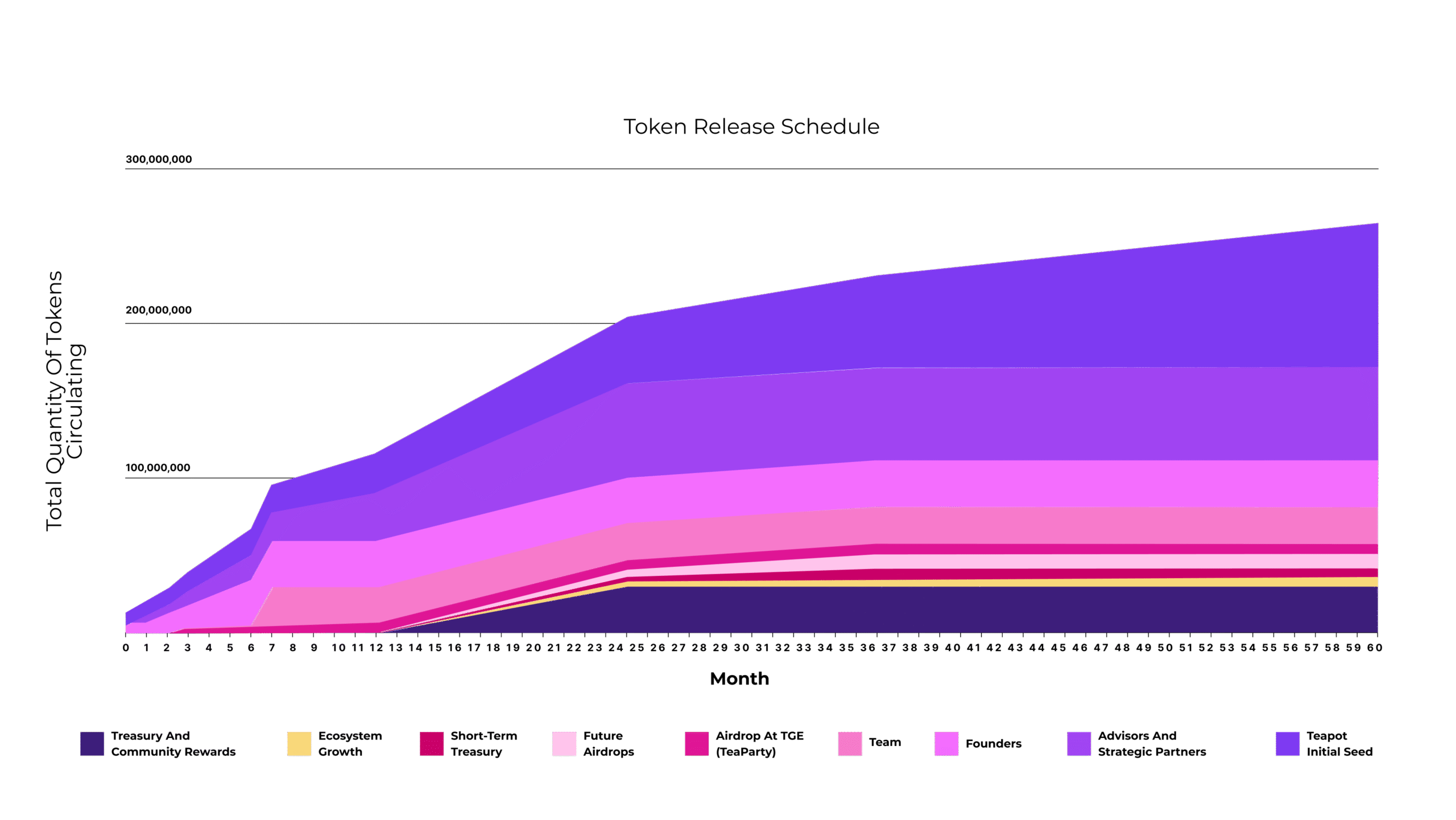

Vesting and Release Structure

Each allocation follows a carefully designed vesting schedule to protect the ecosystem and ensure fair distribution over time.

This structure encourages long-term participation and discourages short-term speculation. Each tranche is designed to mature alongside Tea-Fi’s ecosystem, ensuring capital flows remain consistent with organic growth.

Incentives and Participation

Tea-Fi’s tokenomics are built to reward users who contribute to network activity and community development.

Reward Programs

- TeaDrops: Periodic distributions of $TEA for active users.

- Sugar Cubes: Daily loyalty points that feed into reward tiers.

- Referral Incentives: Multi-level rewards that expand community participation.

- Utility Tiers: Access to boosted APYs, discounts, and early feature releases.

Through these systems, Tea-Fi turns engagement into tangible rewards, creating a model that values activity and consistency.

A Framework for Longevity

In the end, $TEA is more than a token — it’s the heartbeat of a self-sustaining DeFi ecosystem.

By tying real yield to real participation, Tea-Fi builds a model where growth, governance, and community move together. As the ecosystem expands, $TEA continues to do what it was designed for: turning every action into lasting value

Stay tuned for updates and follow @TeaFi_Official on X for the latest news.