Decentralized Finance (DeFi) promised a financial system without middlemen, where anyone could access yield, lending, and trading directly on the blockchain. And while that promise is real, the journey hasn’t been without challenges. From mercenary liquidity to clunky user experiences, the first wave of DeFi apps has struggled to balance growth with sustainability.

At Tea-Fi, we believe the next stage of DeFi will be driven not by isolated protocols, but by ecosystems of aligned applications that share value, reinforce each other, and make DeFi simpler to use. This is the idea behind Protocol-Aligned Applications (PAAs) — and it’s how we’re solving some of the biggest problems holding DeFi back.

The Challenges Facing DeFi Today

DeFi protocols have historically attracted users by offering high token incentives. While this approach initially succeeded in drawing liquidity, it ultimately proved unsustainable. As soon as rewards diminished, users quickly migrated elsewhere, thereby creating a pattern of liquidity churn that prevents ecosystems from developing stable foundations for growth.

Furthermore, user experience remains a significant barrier to wider DeFi adoption. Even the most basic DeFi interactions require multiple transactions, approval steps, and substantial gas fees. This high friction inevitably drives away potential users who find the complexity and cost prohibitive compared to traditional financial alternatives.

In addition to these challenges, another critical issue is the siloed nature of DeFi protocols. By operating independently, these protocols compete for the same liquidity and users without meaningful collaboration. Consequently, this fragmentation prevents value sharing across the ecosystem, thus limiting the potential for synergistic growth that could benefit all participants.

Perhaps most concerning, however, is DeFi’s continued reliance on inflationary token emissions as the primary growth mechanism. Although these emissions create temporary excitement and activity, they rarely generate lasting value because they aren’t supported by genuine revenue or sustainable activity patterns.

The Shifts Reshaping DeFi

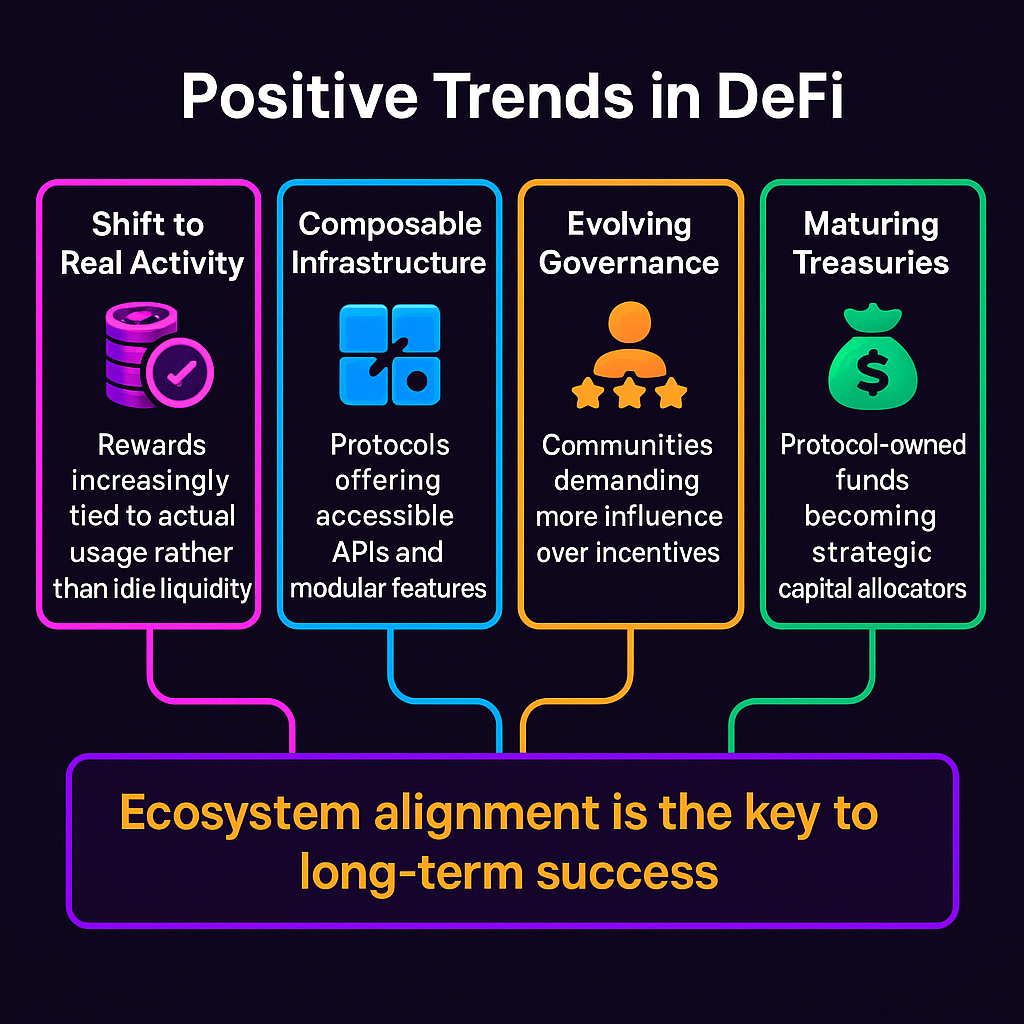

Despite the challenges, however, several encouraging trends are emerging in the DeFi landscape that signal positive evolution. For instance, the industry is gradually shifting from idle liquidity to real activity, with rewards increasingly tied to actual usage such as swaps, vault deposits, and meaningful dApp interactions rather than simply parking assets. This shift represents a fundamental change in how value is created and distributed within DeFi ecosystems.

At the same time, we’re witnessing the rise of composable infrastructure, where protocols are becoming more SaaS-like in nature. In fact, by offering accessible APIs and modular features, these protocols create building blocks that other applications can easily adopt and integrate, thereby fostering innovation and interoperability across the ecosystem.

Moreover, governance is also evolving, with communities increasingly demanding more influence over incentive distribution. As a result, this governance-led alignment ensures that resources flow toward applications that deliver genuine value rather than those merely promising short-term gains. Consequently, communities are becoming more sophisticated in how they evaluate and reward contributions to the ecosystem.

Furthermore, and perhaps most significantly, protocol-owned treasuries are maturing beyond passive holdings to become strategic capital allocators. In this new role, these treasuries now actively invest in aligned protocols, thus creating financial relationships that strengthen the broader ecosystem rather than simply maintaining idle funds on their balance sheets.

Taken together, these trends point toward a future where ecosystem alignment is the key to long-term success.

Enter Protocol-Aligned Apps (PAAs)

Protocol-Aligned Applications (PAAs) are external applications that integrate Tea-Fi’s infrastructure through SaaS layers like No Gas (NOGA), vaults, and smart wallets. By plugging into the Tea-Fi SaaS layer, PAAs become part of the utiliTEA economy, where incentives are tied to real on-chain activity.

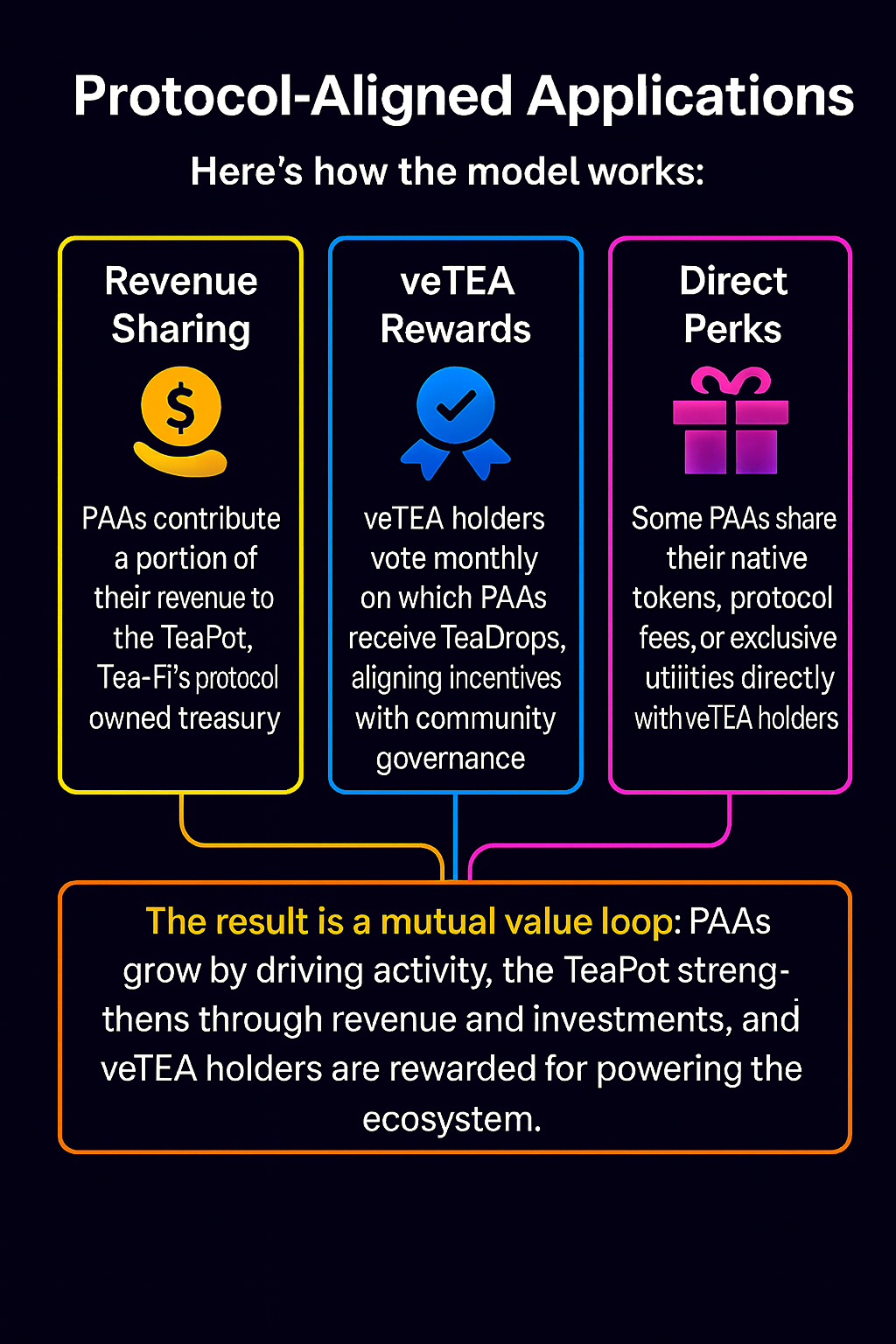

Here’s how the model works:

- Revenue Sharing – PAAs contribute a portion of their revenue to the TeaPOT, Tea-Fi’s protocol-owned treasury.

- vTEA Rewards – vTEA holders vote monthly on which PAAs receive TeaDrops, aligning incentives with community governance.

- Direct Perks – Some PAAs share their native tokens, protocol fees, or exclusive utilities directly with vTEA holders.

The result is a mutual value loop: PAAs grow by driving activity, the TeaPOT strengthens through revenue and investments, and vTEA holders are rewarded for powering the ecosystem.

How PAAs Solve DeFi’s Problems

Liquidity Retention – Instead of chasing mercenary yield, PAAs drive real usage (transactions, deposits, swaps) that sustains activity long-term. By focusing on genuine utility rather than temporary incentives, these applications create sustainable patterns of engagement that persist beyond initial token rewards.

Better UX – Tools like EasyGas remove friction by abstracting gas fees, while smart wallets enable seamless onboarding and auto-yield. This dramatically improves the user experience, making DeFi accessible to newcomers who might otherwise be intimidated by the technical complexity of blockchain interactions.

Ecosystem Synergy – By building on Tea-Fi, PAAs compound growth across the network rather than competing in isolation. This collaborative approach creates network effects where each new application strengthens the entire ecosystem, generating value that benefits all participants.

Sustainable Incentives – Revenue-sharing and governance-directed TeaDrops replace inflationary emissions, making rewards more durable. This shift from token inflation to actual revenue distribution creates a more stable economic foundation that can support long-term growth.

Strategic Capital – The TeaPOT acts as a growth partner, investing directly into PAAs and diversifying returns for the community. This strategic allocation of resources ensures that promising projects receive the support they need while generating returns that flow back to the broader ecosystem.

Benefits for Stakeholders

For PAAs

- Access to Tea-Fi’s user base and infrastructure.

- Visibility and support through veTEA governance.

- Strategic capital from the TeaPOT.

For veTEA Holders

- Influence over where TeaDrops flow.

- Exposure to revenue from multiple PAAs.

- Exclusive perks from aligned apps.

For Users

- Lower costs and better UX.

- Seamless onboarding into DeFi.

- More utilities and incentives across dApps.

Looking Ahead

The future of DeFi won’t be built by isolated protocols fighting for attention. It will be shaped by ecosystems of aligned apps that share growth, reinforce each other, and return value to their communities.

Protocol-Aligned Apps are the foundation of this model. By connecting to Tea-Fi’s ecosystem, contributing to the TeaPOT, and aligning with vTEA governance, PAAs ensure that DeFi grows in a way that is sustainable, scalable, and user-friendly.

Tea-Fi isn’t just building products — it’s building an economy where every aligned app makes the ecosystem stronger.